From Hustler to CEO Bootcamp

Winging It Is Costing You! Learn How to Structure, Save, and Scale — In Just 4 Weeks.

The LAST Marketing Software You’ll Ever Need

A no-fluff bootcamp for new entrepreneurs who want to stop overpaying taxes, set up their business the right way, and build real wealth — just like the 6/7-figure earners do.

You Started Hustling. But Did You Structure to Scale?

72% of new business owners overpay in taxes

Most missed deductions come from poor bookkeeping and missed receipts.

Choosing the wrong entity could cost you $50K+ in funding

Still mixing business and personal funds, you're at a high risk! - lets fix that

Are you ready to operate like a REAL CEO

Too many new entrepreneurs are building businesses on shaky foundations using

Cash App instead of business accounts, guessing their way through taxes, and

choosing the wrong structure that ends up costing them thousands.

The truth? The IRS doesn’t care if you “didn’t know.” And success isn’t just

about making money it’s about keeping it.

The From Hustler to CEO Bootcamp gives you the exact structure, systems,

and tax strategies the wealthy use — broken down in plain, actionable steps

for real entrepreneurs. Whether you're just getting started or ready

to get legit, this bootcamp sets the stage for real growth.

Hustler to CEO

In Just 4 Weeks, You'll Learn:

Week 1: Business Structure Basics —LLC, S Corp, Sole Prop — we break down the best entity for your business and how to get fundable from day one

Week 2: Bookkeeping made simple— Clean books = tax savings. Learn the foundation of smart money management so you're not scrambling every April.

Week 3: Deductions & Receipts —Find hidden tax write-offs, avoid red flags, and keep more of your money (without triggering audits).

Week 4: CEO Level Tax Strategy — Learn how wealthy entrepreneurs use the tax code to scale and save. Plan like a CEO — not a side hustler

Bonus Week 5 for VIP Only: Wealth Conversations with a Financial Advisor.

Your structure is set.Your taxes are optimized. Now what?

Let’s talk investments, financial planning, and long-term moves with a licensed advisor who works with 6- and 7-figure earners.

VIP Walk Includes—

-A private Q&A session with the financial advisor

-Recording of each sessions

Accountability chat

BONUS — Plug-and-play templates and live Q&A sessions

Who This Is For?

New business owners (0–5 years in)

Sole props looking to formalize

Entreprenuers and Business Owners

Anyone who wants to legally keep more of

their income

LETS GET STARTED

Choose Your Bootcamp Experience

BONUS

Private Q&A Session with a licensed financial advisor

Plug-and-play templates to implement instantly

Session replays for 12 months (VIP only!)

Custom next-step checklist to build your wealth roadmap

Access to VIP-only accountability chat to keep you on track

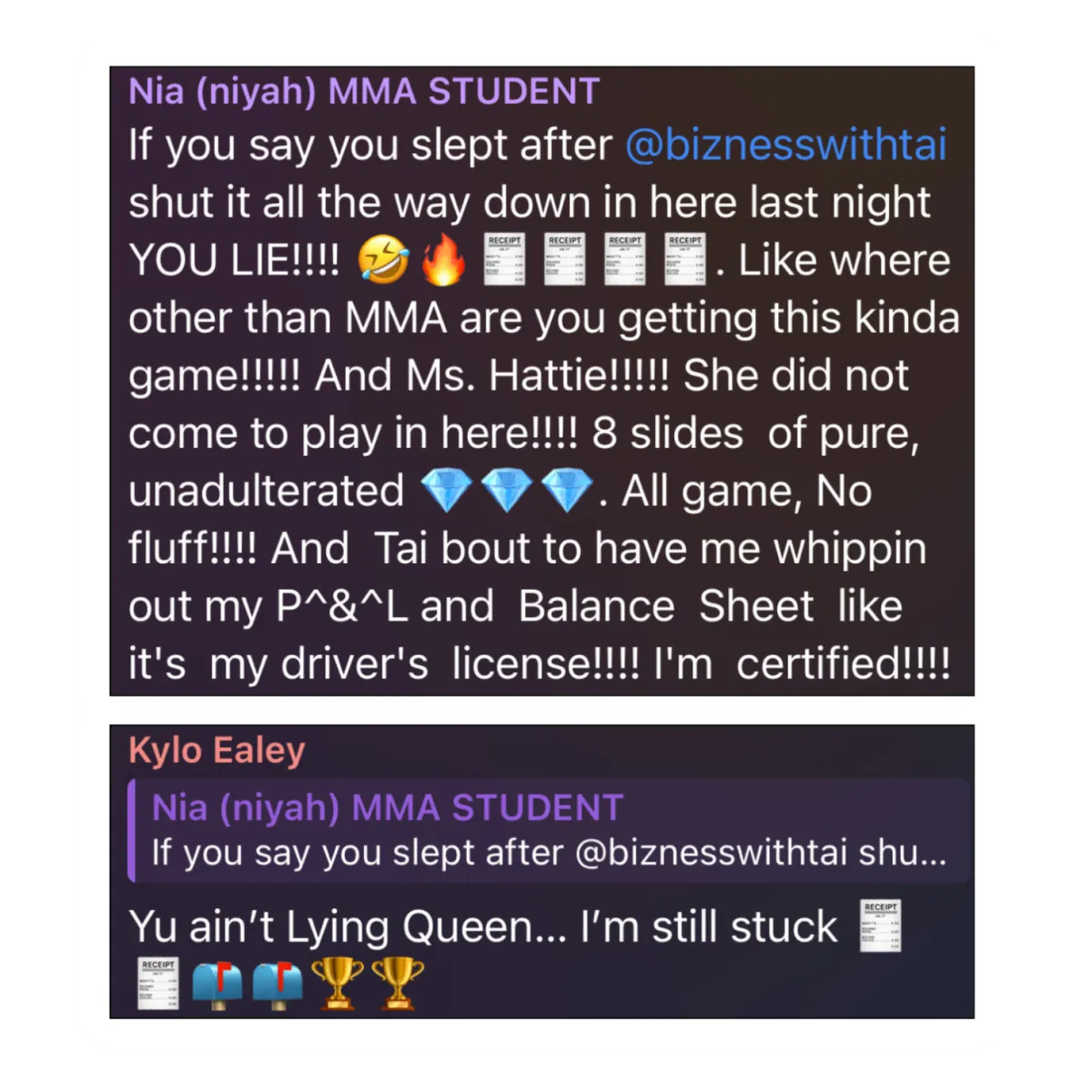

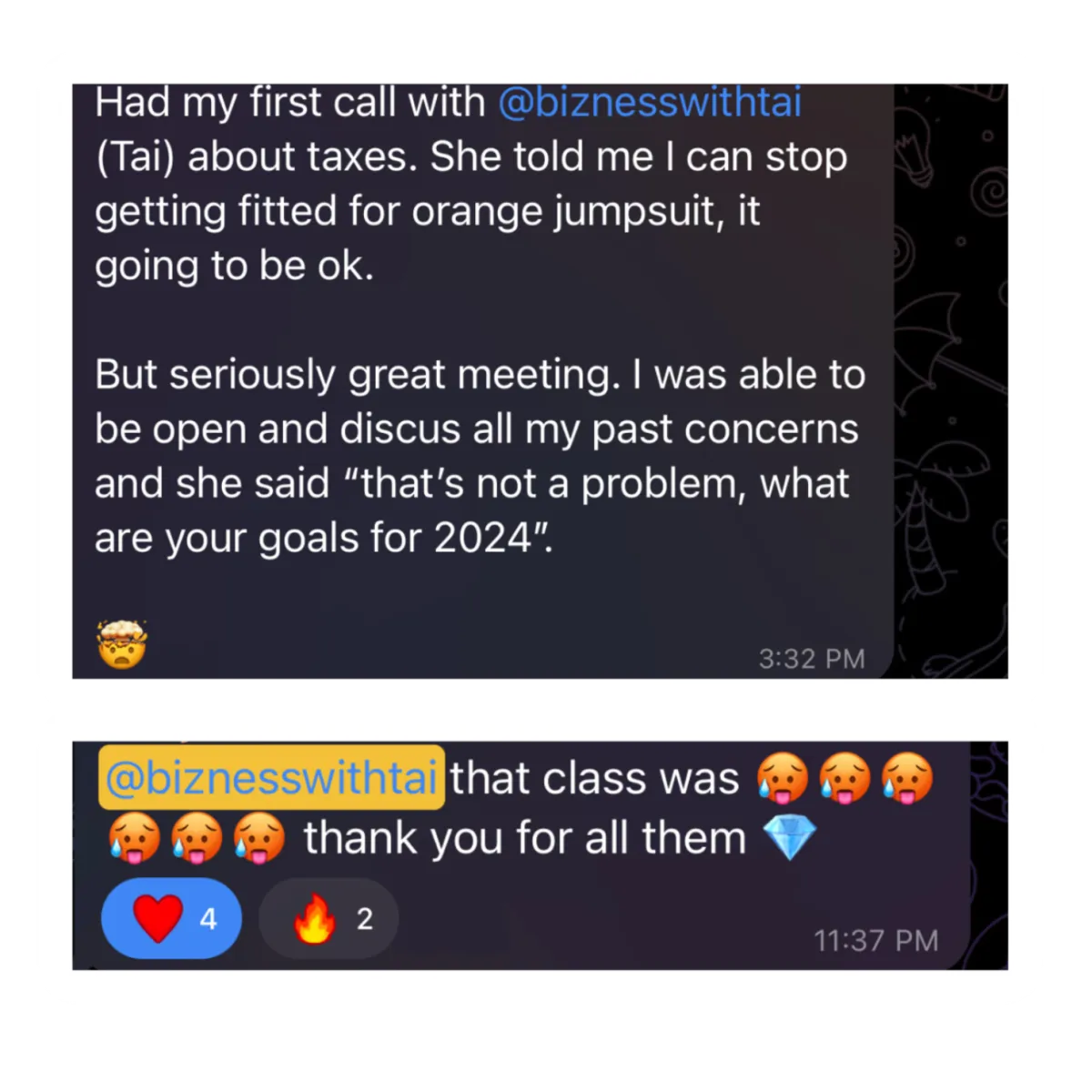

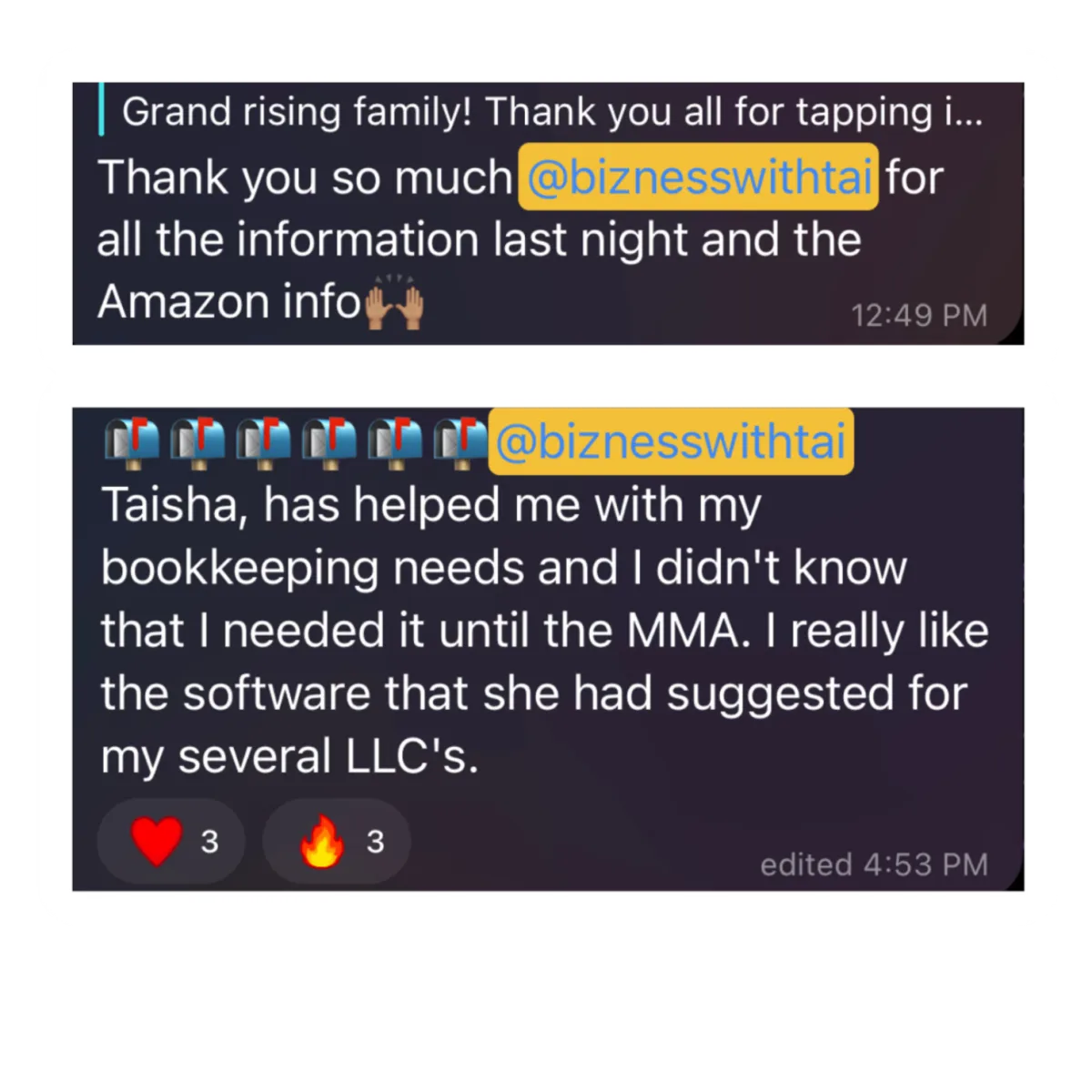

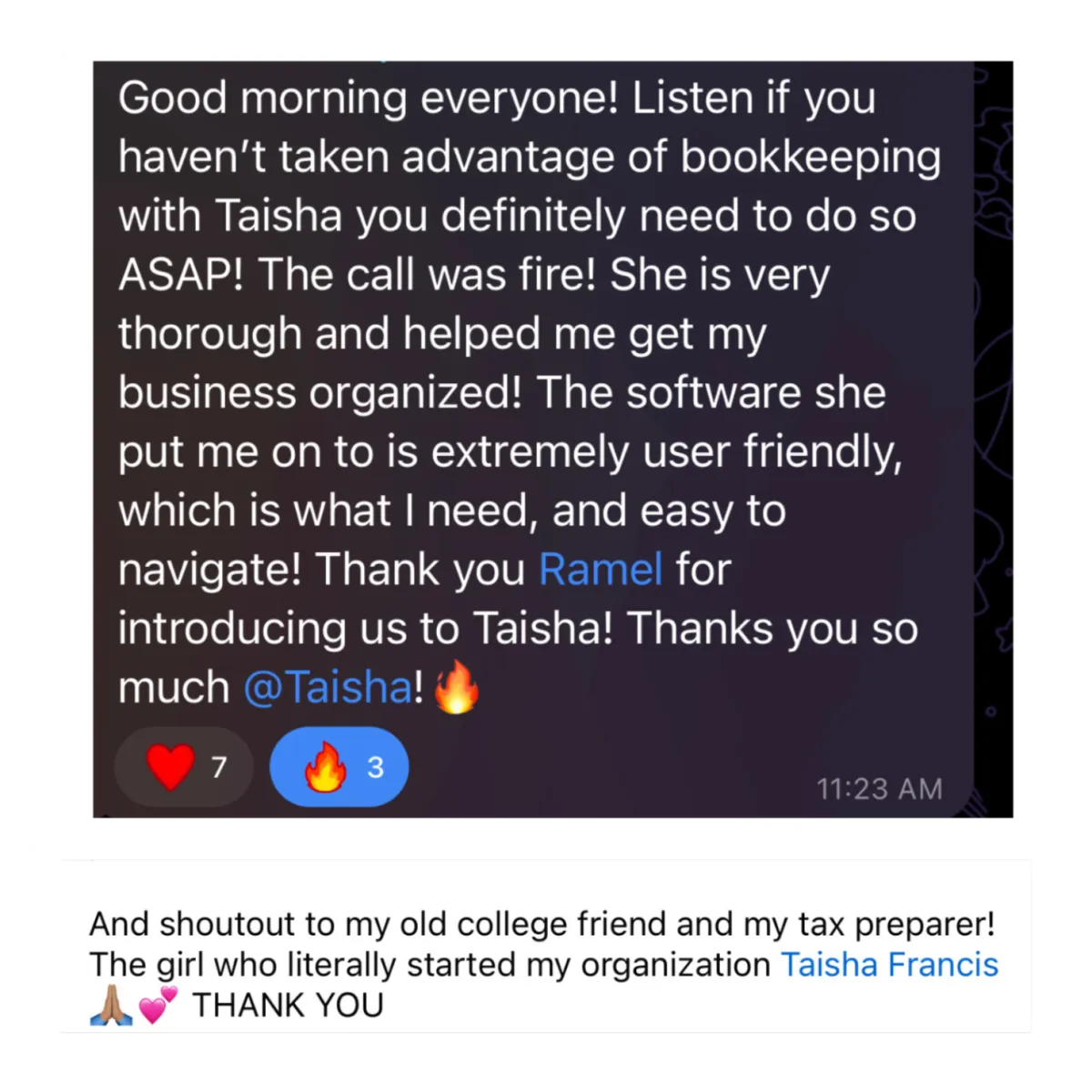

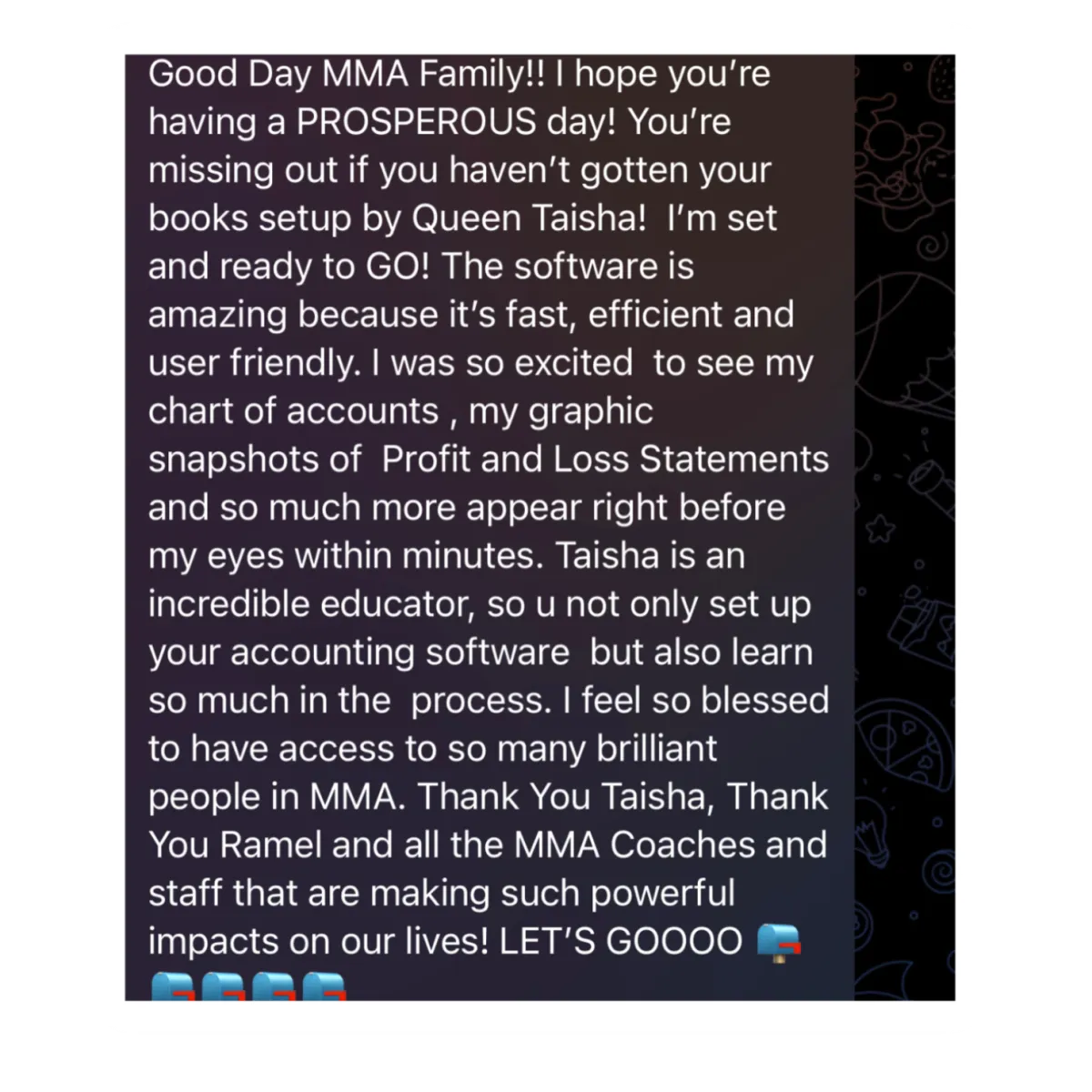

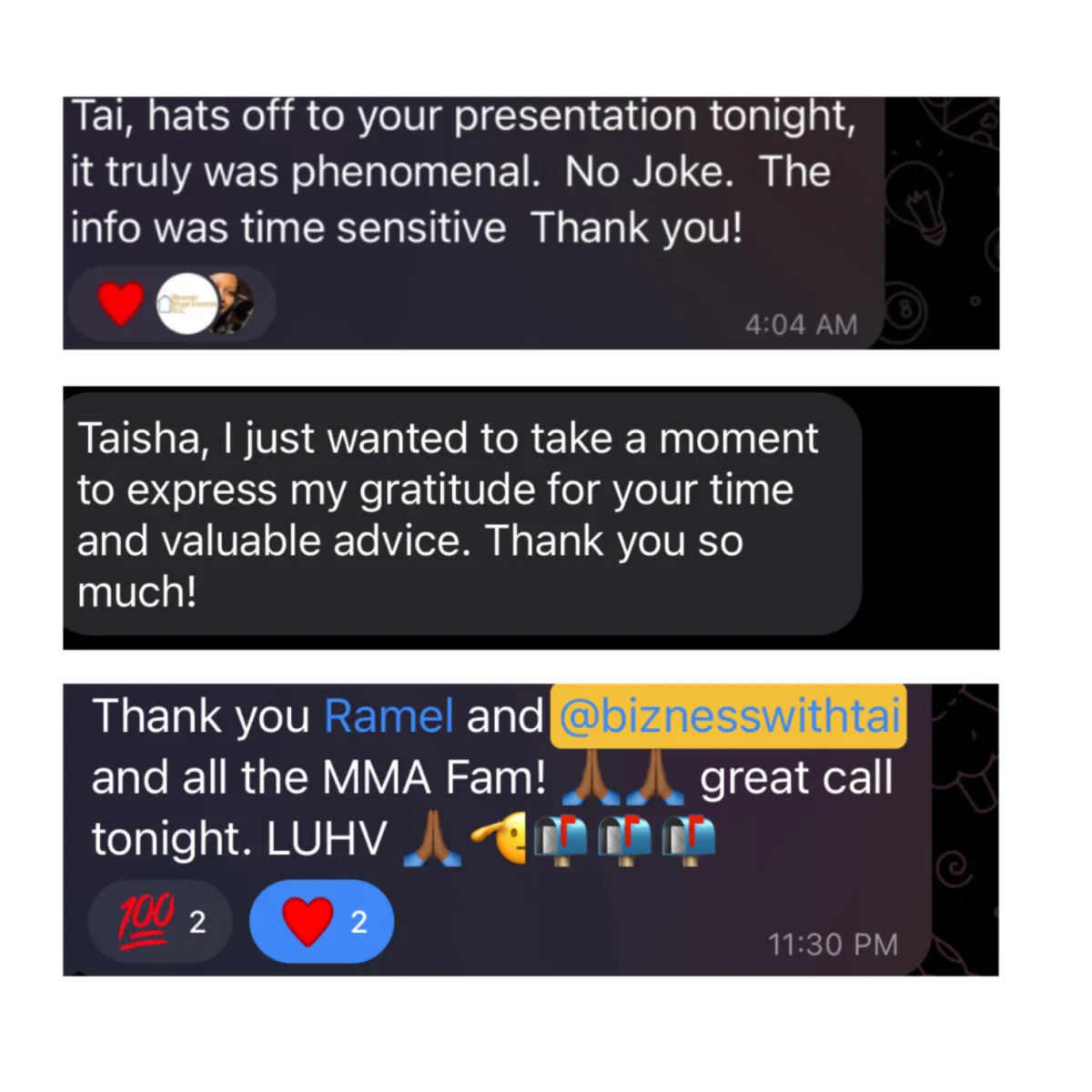

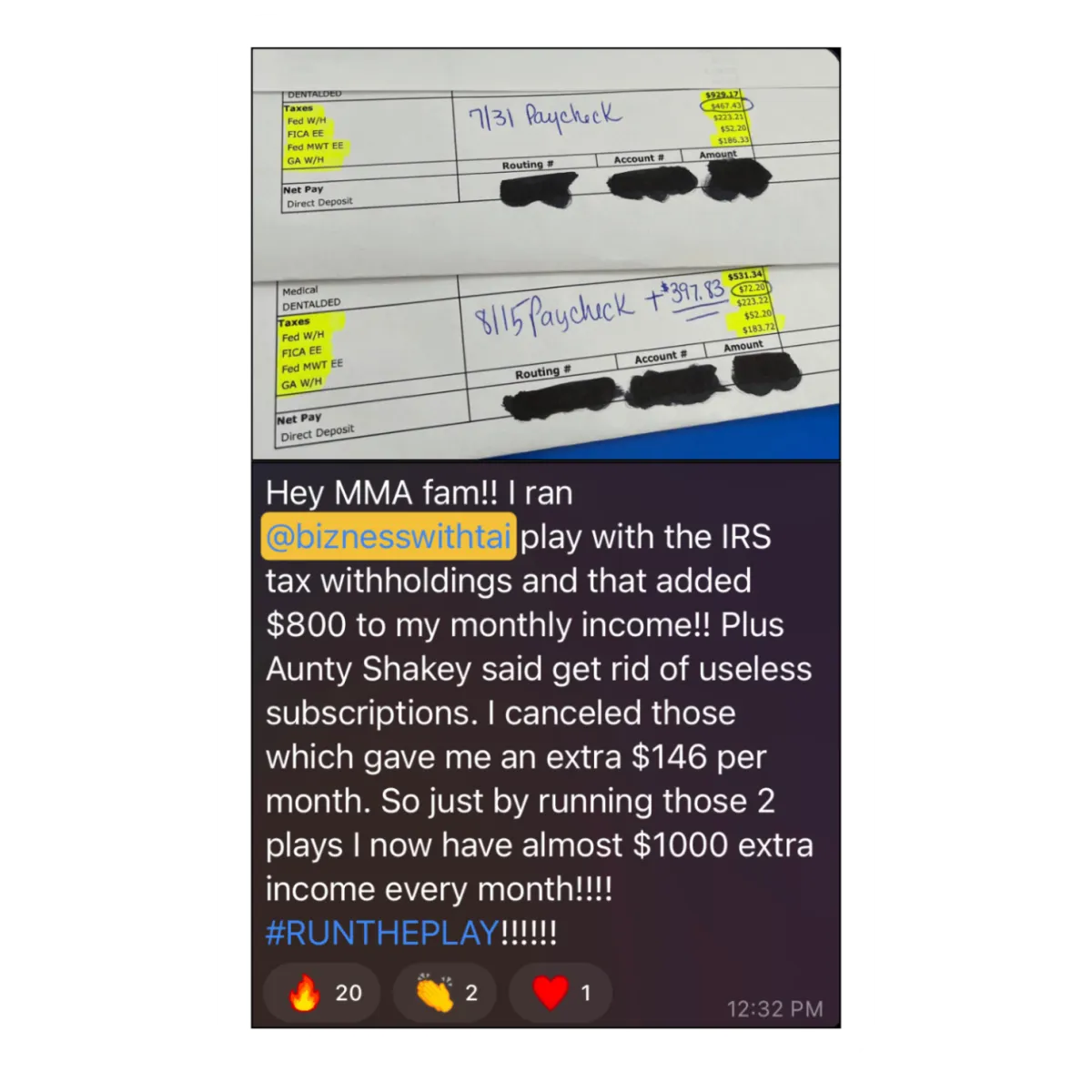

WHAT MY CLIENTS HAVE TO SAY

GOT QUESTIONS?

Frequently Asked Questions

Do I need to know anything about taxes or business?

Nope. This is beginner-friendly and guided step-by-step.

Will this help me file taxes?

It’s designed to help you prepare and prevent problems— not do tax prep.

Can I join if I’ve already started my business?

Yes. This is perfect for filling in the gaps you didn’t know you missed.

Stop Losing Money to DIY Mistakes & Bad Business Structure

Every month you delay fixing your business setup, you’re leaving thousands on the table in taxes, lost deductions, and missed funding opportunities.

Your move now can save you years of frustration later.